…Redevelopment and new development projects like Urban Regeneration and Sprawl Retrofit need sources of revenue.

__Problem-statement: How can the benefits of future improvements be transmitted financially to the present day, so that they are economically viable in the period before they generate profit?__

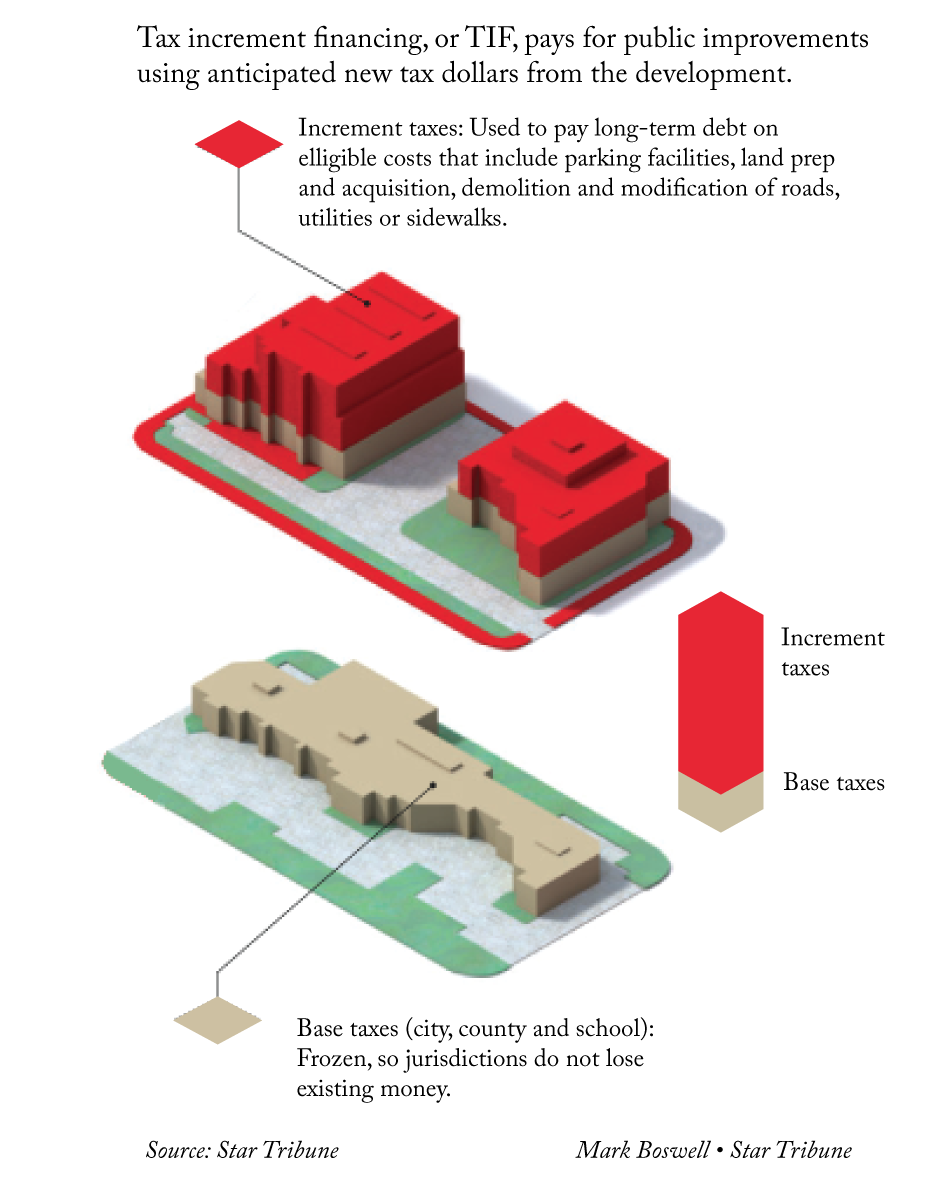

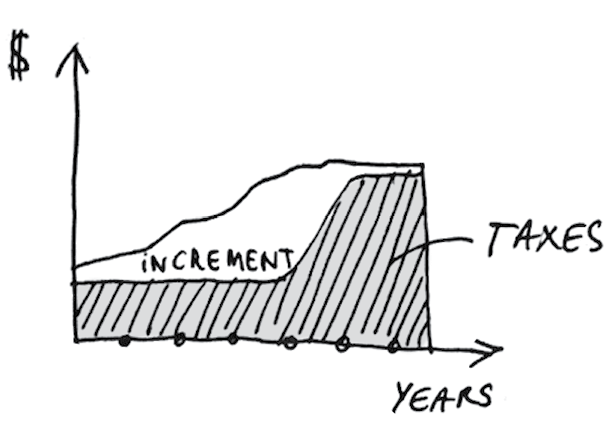

Discussion: One of the most common mechanisms to accomplish this goal is known as tax increment finance. In essence the government entity with taxing power recognizes that the improvements will generate an increment of increased taxes (through sales tax, income tax, property tax or other means) and this increased revenue can be used to service a bond or pay back a revenue expenditure to the taxpayers.

Care must be taken in tax increment finance projects to avoid commingling the public sector with its interests and priorities, with the private sector with its own distinct interests and priorities. This is best done by focusing expenditures on public improvements, including utilities, transportation infrastructure, and especially, public space improvements.¹

We also have to be careful in how we allocate money raised by such taxes. Spending money optimally has to be done using a “fractal cost distribution” — many small budgets for small projects, a few large budgets for large projects, and a moderate number of budgets for medium projects. When each project competes with the others for funding, it is easy to concentrate on the largest projects, because those need the most money. But this top-heavy mindset too often ignores the intermediate and small-scale projects. A systemic imbalance towards the largest scale will shape the built environment in undesirable ways, and this bias can be overcome by explicitly supporting the more numerous smaller funding parcels.

__Therefore: Use tax increment finance to fund a project early in its life, before it has generated revenue. Take care that the risk of financial failure is mitigated with private forms of insurance, rather than public financial risk. Make sure that the funding priorities are not skewed towards the largest projects, and are targeted to a mix of small and medium projects as well.__

Use tax increment finance carefully with Land Value Capture, since they can operate at cross purposes. For example, a dependence on property value tax to service debt of tax increment finance can make it difficult to implement land value tax. Therefore, it is better to rely on other streams of revenue than property tax to service tax increment finance. …

notes

¹ For more see e.g. Johnson, C. L., & Kriz, K. A. (Eds.). (2019). Tax Increment Financing and Economic Development: Uses, structures, and impact. Albany NY: SUNY Press.

See more Project Economics Patterns